Past Event

USALI 12th Edition Workshop: Understanding the Latest Financial Reporting Standards organized by the HCAA

2025-10-09

Past Event

Air Passenger Departure Tax (APDT) Exemption

2025-09-29

Past Event

Written Reply by Financial Services and Treasury Bureau in LegCo on Hotel Accommodation Tax

2025-09-10

Past Event

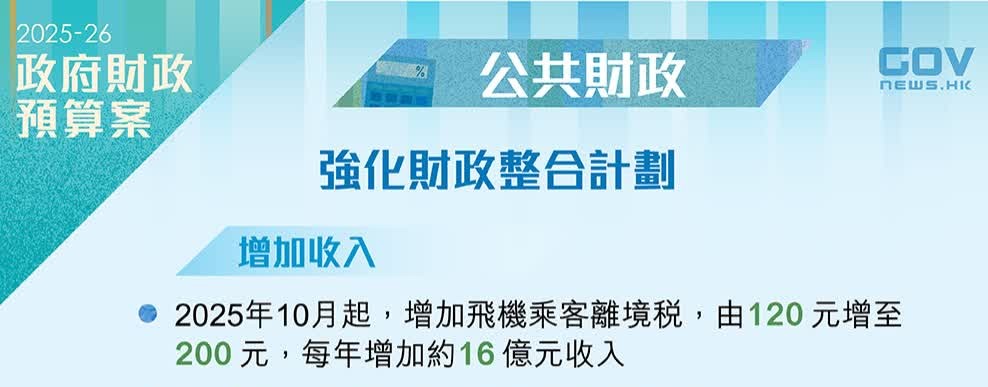

Air Passenger Departure Tax Takes Effect in October

2025-05-30

Past Event

Hotel Accommodation Tax (HAT) – Meeting Update, Filing Support, and Key Reminders

2025-05-29

Past Event

Hotel Rateable Valuation 2025/26

2025-05-14

Past Event

2025-05-13

Past Event

Meeting with OTA Representatives from Trip.com on HAT

2025-01-27

#HAT

Past Event

Hotel Tax Exemption Arrangements under the Hotel Accommodation Tax Ordinance (HATO)

2025-01-20

#HAT

Past Event

Hotel Accommodation Tax (HAT): Hotel Proprietor Responsibilities Under Cap. 348

2025-01-09

#HAT