The Federation of Hong Kong Hotel Owners (The Federation) is pleased to report to our members the 2024-25 Budget announced by the Financial Secretary Mr Paul Chan today. This budget signifies a significant step towards the continued growth and prosperity of the Hong Kong economy. We are happy to report that some of our recommendations have been reflected in this year's budget announcement and some highlights related to the hotel and hospitalitiy industry.

Relevant information, including the full document of the Budget Speech and leaflet, is now available on the official website: https://www.budget.gov.hk/2024/eng/index.html

The 2024-25 Budget - Home

Property Market

-

Cancel Special Stamp Duty, Buyers’ Stamp Duty and New Residential Stamp Duty for residential properties with immediate effect

Building the Hong Kong Brand

-

Allocate over $1.09 billion to strengthen tourism development and organise events. Highlights include:

-

Splendid Victoria Harbour: Monthly pyrotechnic and drone shows; and revamping “A Symphony of Lights”. Pilot scheme on F&B, retail and entertainment facilities at the harbourfront

-

Immersive and in-depth tourism: based on themes such as “Citywalk”

-

Young-adult focused activities: hiking, cycling, stand-up paddleboarding, trail running and stargazing

-

Local characteristics: continue to hold “Sai Kung Hoi Arts Festival” and “Design District Hong Kong”

-

Launch a new Hong Kong tourism brand

-

Promote multi-destination tourism in collaboration with GBA cities

-

Quality tourism services: Launch new round of publicity to promote Hong Kong as a hospitable city

-

Earmark $100 million to boost mega-event promotions over next 3 years

-

Continue to organise thematic financial forums, such as the Global Financial Leaders’ Investment Summit and the Wealth for Good in Hong Kong Summit

-

Launch a new Sponsored Overseas Speaking Engagement Programme to sponsor renowned scholars and industry leaders in promoting Hong Kong overseas

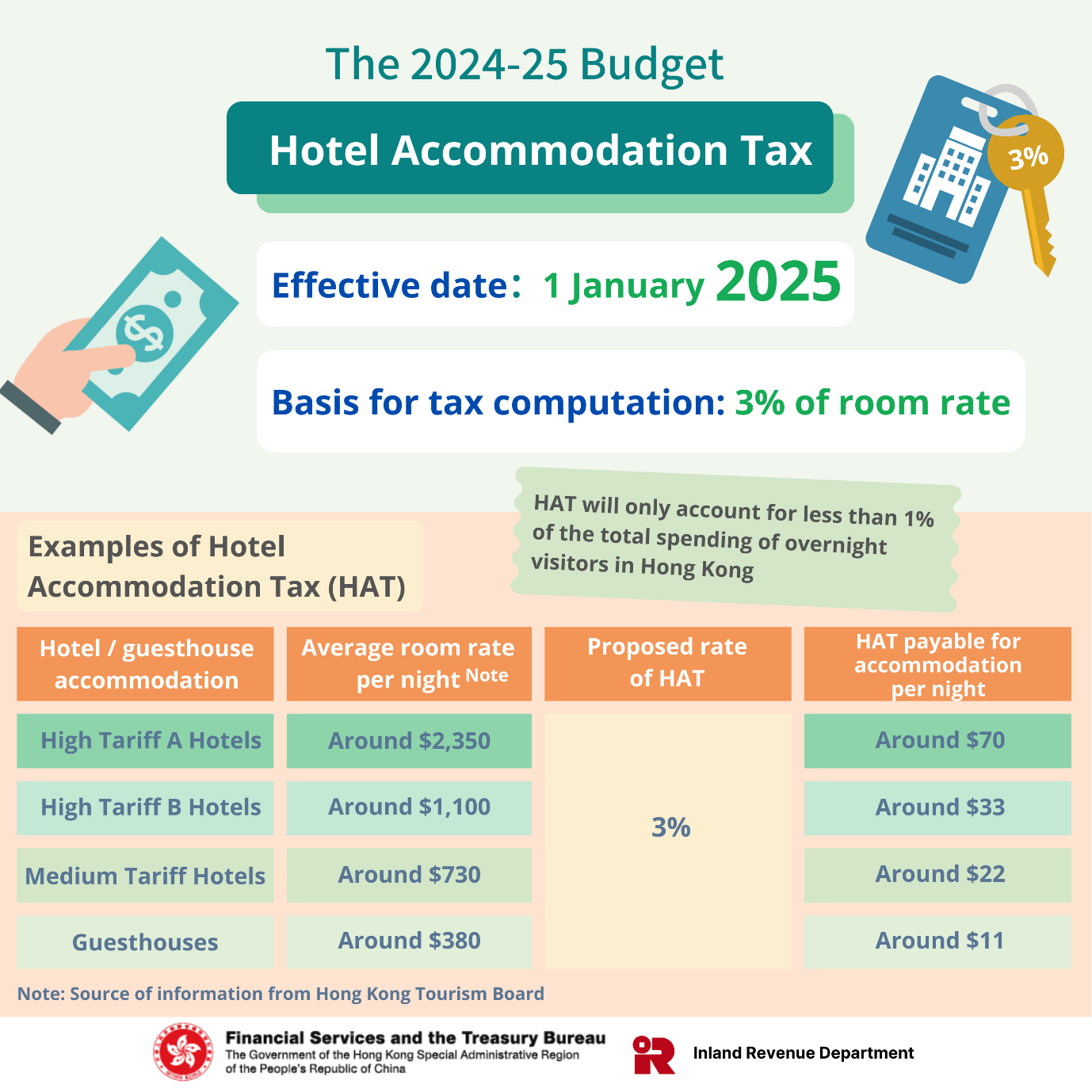

Re-imposition of the Hotel Accommodation Tax at 3%

While we acknowledge and appreciate the positive aspects in this year's Budget announcement, the government has also proposed to resume the collection of the Hotel Accommodation Tax (HAT) at a rate of 3%. It is anticipated that government revenue will increase by about $1.1 billion per annum. This will take effect from 1 January 2025 in order to allow the hotel and tourism industries more time for preparation. The HAT to be collected is estimated to only account for less than one per cent of the total spending of overnight visitors in Hong Kong. In the coming year, the Government plans to allocate over $1 billion for upgrading tourism infrastructure and services to attract more highspending overnight visitors from different visitor source markets to Hong Kong.

The Government will move a resolution at the Legislative Council to give effect to the proposal in due course. The Inland Revenue Department (IRD) will notify you further of the HAT when the resolution is gazetted. The IRD will also issue letters to hotel/guesthouse operators today advising them of the impact of the proposal as well as the recommended preparatory work to be carried out by them.

General Guidelines for Determination of the Amount of Accommodation Charge for the Hotel Accommodation Tax (HAT)

The provisions

-

Under the HATO, the HAT is levied at the rate of 0%, with effect from 1 July 2008, (the tax rate was at 3% for period up to 30 June 2008) on all accommodation charges. Accommodation charge is defined in the HATO as the sum payable by or on behalf of guests for accommodation received. Payment can be in the form of money or money's worth – including any credit, book entry, set off or any other act by which a debt due to the proprietor of a hotel for accommodation charges may be discharged.

Cases in general

-

In most cases, the accommodation charge is the agreed price paid by or on behalf of the guest for the hotel room.

If the hotel room is provided to a person in return for a service

-

If a contract has been signed by the hotel with a person for providing some services of a particular value (such as advertising, etc.) in exchange for the provision of a number of hotel room-nights as stated in the contract, the HAT is levied on the value as stated (commonly known as the barter rate).

-

If no value is stated in the contract, or if no contract is signed, the HAT is levied on the average room rate offered to other customers for the same type of hotel room on the day the hotel room is occupied by the service provider (or his agent).

Cash coupons

-

If the guest has used cash coupon(s) issued by the hotel or other entities to settle the hotel room charge, or part of the hotel room charge, the value of the cash coupon(s) is subject to the HAT as it is money's worth.

Service charges

-

The normal 10% service charges added to the room rate are exempt from the HAT. Any additional service charges (on top of 10%) for services incidental to the provision of the hotel room (such as newspaper services, etc.) are part of the accommodation charge for the calculation of the HAT.

Exemption

The provisions of the Hotel Accommodation Tax Ordinance shall not apply to accommodation charges where the Collector is satisfied that:-

-

the rate of the accommodation charge is less than $15 per day;

-

the accommodation is provided by society (i.e. any club, company, school, institute, association or other body of persons by whatever name called) not established or conducted for profit; or

-

the hotel contains less than 10 rooms normally available for lodging guests.

Note : For certain types of accommodation which have clear characteristics of not being accommodation provided to "guests", e.g. the 28 days accommodation referred to in the Hotel and Guesthouse Accommodation (Exclusion) Order, IRD generally accept that they are excluded from the charge of Hotel Accommodation Tax. However, each case has to be decided on its own merits.

If you have any questions about this proposal, please contact the Inland Revenue Department - Inspection Section at 2594 3066 (email: taxinfo@ird.gov.hk). Information about this proposal with FAQ is also available on the IRD website at https://www.ird.gov.hk/eng/tax/hat.htm

We encourage you to share any feedback or concerns you may have about this year's Budget Speech to the Federation. Your input will help us better advocate for your needs and present a unified front in our discussions with the government. As we move forward, we will closely monitor the implementation of the budget recommendations and its impact on our industry. The Federation will continue to work closely with the government, advocating for the best interests of our members and collaborating to create a vibrant and prosperous hotel landscape in Hong Kong.